Problem:

A prominent mortgage lender identified a significant risk within their portfolio linked to the degeneration of neighborhoods. Over time, some properties backed by their mortgages had depreciated due to the worsening conditions of the areas they were located in. This situation escalated the loan-to-value ratio of these mortgages, increasing the financial risk. Eager to address this issue, the lender sought to better understand the livability of these neighborhoods and how it might change, focusing on the social aspects of the Environmental, Social, and Governance (ESG) criteria.

Solution:

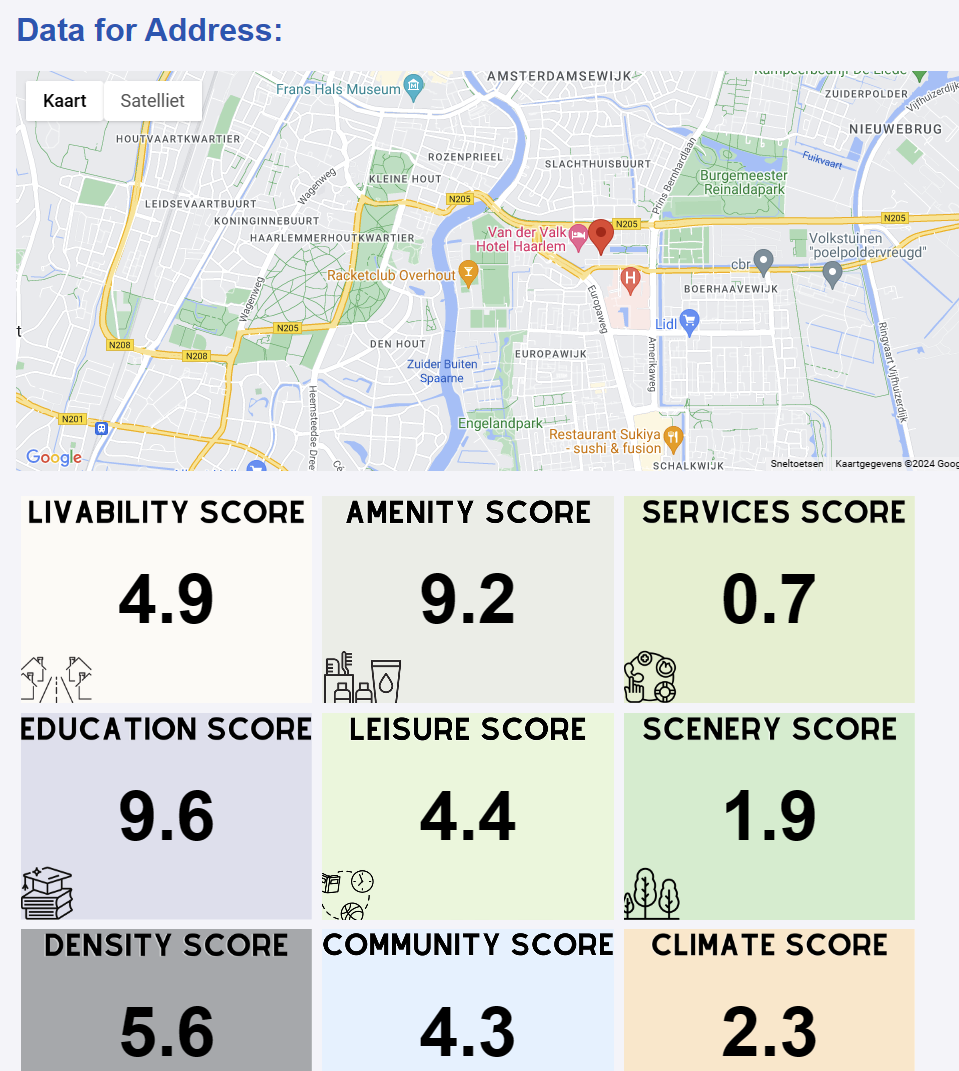

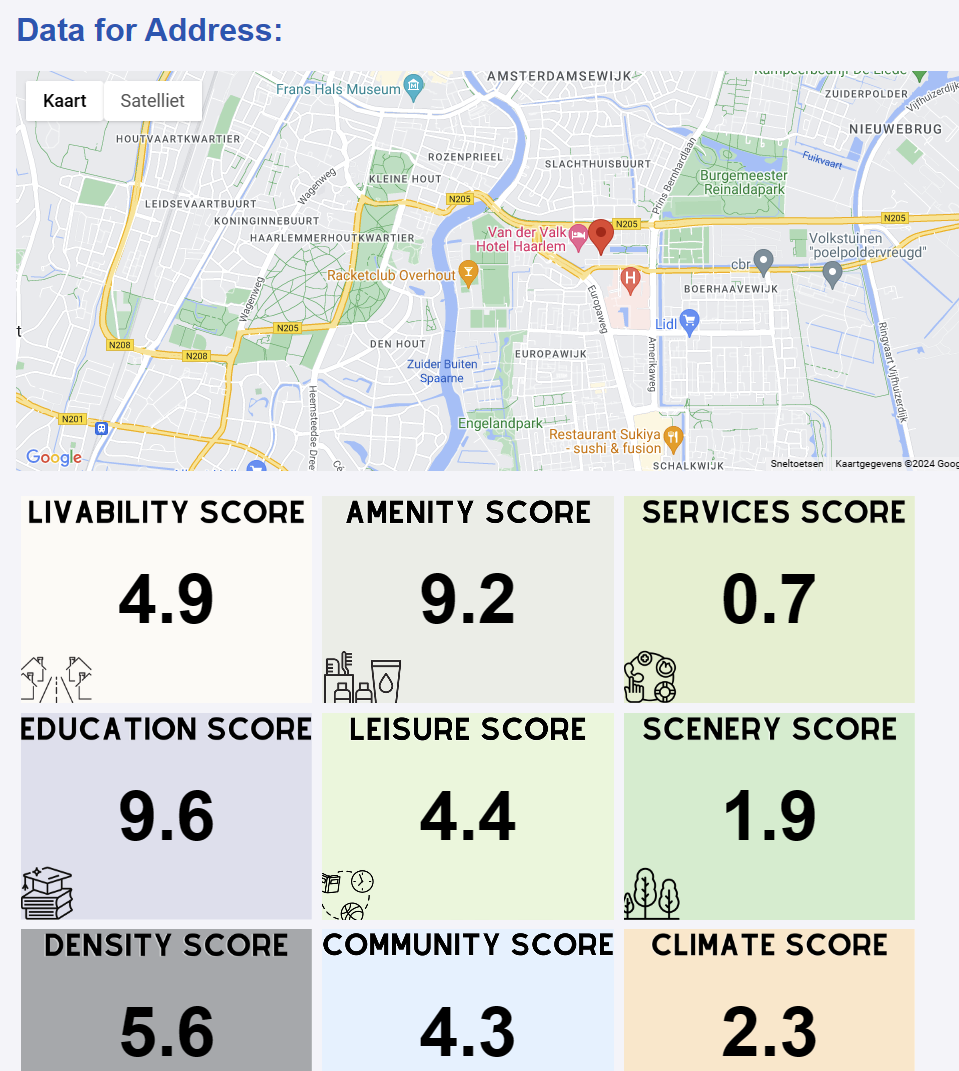

Viewwave responded by designing a comprehensive analytical tool that leverages social data sourced from an external provider. Utilizing historical insights from a Intelligent Experience (Int X), Viewwave developed tailored models to assess various facets of neighborhood livability, including accessibility to amenities and service facilities. These models generated livability scores for each property, providing a comparative basis to monitor changes over time. By incorporating historical trends, the tool could also predict shifts due to gentrification or degentrification. A dynamic dashboard was created to facilitate an intuitive interaction with the data, allowing the lender to visualize and interpret these insights effectively.

These models generated livability scores for each property, providing a comparative basis to monitor changes over time. By incorporating historical trends, the tool could also predict shifts due to gentrification or degentrification. A dynamic dashboard was created to facilitate an intuitive interaction with the data, allowing the lender to visualize and interpret these insights effectively.

Impact:

With the implementation of this solution, the lender is now equipped to generate regular reports that assess the social quality of their properties. This capability has significantly improved their ability to pinpoint potential risks associated with neighborhood decline. Furthermore, the lender has used these insights to refine their lending strategies, prioritizing loans in neighborhoods that are stable or showing signs of improvement, thereby better managing their portfolio risk.

Summary

What sets Viewwave apart is our commitment to delivering tailored solutions that address the unique challenges of each client. No two companies are alike, which is why we take the time to understand our clients' needs and craft solutions that seamlessly integrate with their existing processes.

If your company is looking to implement bespoke ESG solutions or integrate third-party data streams into existing solutions, look no further. Contact Viewwave today to learn how we can help you transform your data landscape and achieve sustainable business growth.

These models generated livability scores for each property, providing a comparative basis to monitor changes over time. By incorporating historical trends, the tool could also predict shifts due to gentrification or degentrification. A dynamic dashboard was created to facilitate an intuitive interaction with the data, allowing the lender to visualize and interpret these insights effectively.

These models generated livability scores for each property, providing a comparative basis to monitor changes over time. By incorporating historical trends, the tool could also predict shifts due to gentrification or degentrification. A dynamic dashboard was created to facilitate an intuitive interaction with the data, allowing the lender to visualize and interpret these insights effectively.